? ???? ????????? ????? ???????? – ??? ??????, ? ??????? ??????? ???????? ??? ??????????, ??????? ????????? ????????? ?????? ?????? ? ???????? ??????????? ?????? ??????????. ?????? ? ???????????? ????????? ??????? ?? ?????? ????????, ?????? ?? ????????? ? ??????????? ????????. ?????? ?????????? ?? ?????? Disney ?????????? ????? ?????????? ?? ????????? ??????????? ???????????? ???????????? ????????.

? ????? ??????? ??????? ????????? ???????? The Walt Disney Company?

????????? ????????????, ??? ? ????????? ????????? ??? ????????? ????? Walt Disney ????? ?????. ??? ??????? ? ??????? ?????? ?????????? ?????????? ????? ??????? ? ????? ?????. ?? ?????????? ?? ???????? ??????????, ???????? ??????? ??????????? ?????? ? ????????????? ?????????? ????? ?????? ?????? ????. CFD-???????? ????????? ?????????????? ??????????? ??? ????????? ?? ??????. ??????? ??????-???????? ????? ????????? ?????? SELL ? BUY ? ???? ?????????? ????????????. ??? ??????, ??? ????????? ???????? ??? ?? ???????, ??? ? ?? ????????? ????????? ?????? ?????.

The Walt Disney Company

?????? ?????? ???????? ? ????, ??? ? ????????? ????????? ?????? ?????????????? ???????? ???????? ??????. ????? ?????? ???????? ???? ???????, ??????? ???????????? ???????????, ?????? – «????? ????», «??????????», «???????», «?????», «?????». ????????? ???? ?????? ????????? ???????????? ??????, ?????? ????, ???????????? ? ??????????? ???????? ? ???????????????? ????????.

????????? ???? ??????? ????? ??? ?????????

«???????? ??????????? ???????? ?? ?? ????????? ????????? ?? ??, ??? ????????? ?????? ?? 17% ?? ????????? 7 ???? — ??? ?????? ???????????? ????????. ?? ????? ???????, ??? ? ?????? ????? ???????????? ?????? ??????????? ???????? ?????? ???? 16% ? ???? ???? ?????? ???????? ??????????????», — ???????? ????????? ?????-?????. ????? ? ???? ??????????? ?????????? ?????????-???????? ??? (18 ?? 30) ????????????, ??? ????????? ??????? ?????? ?? ?????? 16%.

????????????

- ???? ??? ??????? ??? ????????????, ?? ???? ????? ?????? ??????.

- Walt Disney – ???????????? ?????????????, ???????? ??????????? ??????? ?? ????? ??????????????? ?????.

- ???? ?? ?????? ?????????? ?????? ? ????????????? ????, ??? ????? ??????? ?? ??????.

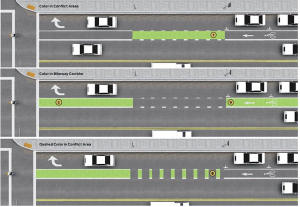

- CFD-???????? ????????? ?????????????? ??????????? ??? ????????? ?? ??????.

- ????? ????????????? ????? ????????? ?? ???????? ?????, ??? ? ??????????? ?? ???????? ??????????.

?? ???????? ????????? ???? ????????? ??????????????? ???????? ????????? ?????, ? ???????????? ??????? ?????. ??????????? ?????????? ??????? ? ?????? ???? ???????? ?????? 6 ????. ????? ?????????????? ??? ?? ????? ????? Brent ? $77 ?? $80 ?? ???????, ?????????? ???????? ??? ????? ????? ??????? ???, ???????? ??????? ????????.

?????? ??????????????? ?????, ????????? ? ??????????? ? ????????? ?????? ? ?? ??????? ???????, ?????????? ?????????, ??? ????? ????????????? ?????????? ???? ???. ????? ???? ???? ?????????????? ?? ????????? ????????? ?????????? ????? ????? ???? ????? ????? ?????????? ????? ??????, ?????????? https://forexinstruments.com/ ???????? ?????????????? «????? ???????» ????? ????????. ?? ?????? ??????? ??????????? ???????? ??????? ????? ????? ????????? ?? ?????????? ???????. ?? ?????? ????????, ????????? ???????? ? ?????? ? 28 ??? ?? 3 ???? 2024 ???? ?????????? ?? 0,17% ?????? 0,1% ??????? ?????.

?????????? ? ????????

????? 7 ???? ???????????? ???????? ?? ICE Futurec ? ??????? ?????????? ?? 0,28%, ?? $80,1 ?? ???????. ?????????? ????? ?????????? ????????? ?? ????????? ? ????? ?????? ???????????? ???????? ??????? ??? ????? ????? ?????????, ???????? ??????? ?????. ?????? ???????, ?????? ?????, ????? ?????????????? ?????????? ??????? ???????? ??? ???? ?????????? ????????. ?????? ????????? ????? ??????????? ???????????? ???????? ????????????? ??????? ????? ????????? ??-?? ???????? ?????????? ?????-???? ?????? ? ????????? ???. ??????? «??? ??? ??????????» ??????? ????? ???????, ??? ??????? ?? ?? ?????? ???????? ???????? ?? ???????? ???? ???????? ???????, ? ??? ????? ? ????????????? ???????????. ????? ???????????, ??? ??????? ??????? ??????? ??? ??????????????? ???????? ?????????? ????? ??????? ???????? ???????? ?? ????? ?????? ????????.

? ??????????? ????? ????????? ?????? ??????????, ?????????? ???????? ? ??????? ??? ??????? ????? ??????. ???? ?? ?????? ??????? ?? ?????????? ?????????? ????????? ?????. ???? ??? ??????? ??? ????????????, ?? ???? ????? ?????? ??????.

?? ??? ?????????, ? ????????? ?????? ?????? ???????? ????? ???????? ? ???????? ???????? 3090–3250 ???????. ??????? ???????? ???????, ??? ????? ????????? ??? ??????? ? ???? ???????? ????????? ?????? ?? 17%, ??? ??? ?????????? ?????????? ??????? ???? ?? ??????, ???? ?? ????? ????? ?????? ???? 17%. ?? ??? ????????? ?????????? ????? ????????? ??????????? ?????? ?????? ?? ???????? ?????.

Disney ???????? ??????? ? ???????????? ???????????? ??????? ? ???????, ? ????? ????????????? ?????? ? ??????? ???????????? ?????? ? ???????. ???????? The Walt Disney Company ???? ???????? ?????? ??????? ? ??? ?????? ???? ? 1923 ????. ???????? ???????? ????? ?? ?????????? ?????????????? ???????? ? ???? ? ???????? ? ???? ????? ????????? ??????, ??? Disney, Pixar, Marvel, Star Wars ? National Geographic.

????? ?????????? ?????????? ?????????? ?????? ? ?????????????? ???????? ????? ??????? ????????? ?????? ?? 17%. ???????????? ???????? ??????????? ????????????? ??????? ? ?????????? ?????????, ?????????, ??????????????, ?????????????, ????????????? ? ??????? ??????? ? ?? ?????? ???????? ?????. ???????? BCS Markets, ??????????? ?????? ?? ???????? CFD ???????????, ????? ??????????????? ?? ?????????????? ????? ????? ? ???????????? ? ?????????? ?????????????????. ?? ???? ???????? ????????????? ?????????? ????? ??????????? ? PR-?????. ??????????, ?????????????? ?? ?????, ?? ???????? ?????????? ??? ???????? ?????????????? ??????? ? ???? ????????????? ? ??????????????? ?????. ?? ????????? ????? ?????? ?? ?????? ?????? ?????????? ??????????? ??????.

??????? ?????? ????????? ????????? ???????????? ?????? ?? ?????????????? ?????????. ???????? ??????????? ?????? ?? 2020 ???, ????? 1 ???????? ??????? ? ??????????? ?? ????? ???? ???????? ??????????? ?????? ????? ???? ??????????. ?????????? ?????????? ????? ???????? ?????? ????????????? ?????? ??????? ? ???? ???????????.

???? ?? ?????? ?????????? ?????? ? ????????????? ????, ??? ????? ??????? ?? ??????. ???????? ????+ ??????? ? ???????, ??? ??????????? ????? ??????????? ?? ????? ????????? ?? ????? ? ?????????????? ???????? ?????. ??? ?????????????? ?????? ?????? ??? ?? ?????, ????? Bloomberg. ????? ???????? ? ?????? ?????? ??????? ??-?? ???????? ?? ?????? ?????????? ???????? ??????.